This is a comprehensive overview of Jason Drummond’s conduct in the operations of GMGT. It highlights potential fraud, misfeasance, and clear neglect of a company officer’s fiduciary duties.

In summary, this article shows how Jason Drummond has most recently caused losses in excess of $18,000,000 to investors.

These losses form part of a trend which goes back over two decades to the year 2000 when many investors in Drummond’s first public company, Virtual Internet lost most of the value of their investment.

The establishment of GMGT

After running Gametech UK Limited into the ground in 2017, Jason Drummond conspired with wanted and convicted criminals Daniel Ferris and Ronald Bauer, who sought to acquire the assets of Gametech UK with the assistance Oliver Willett of Epsilon Investments Pte Ltd and Jason Smart of Fairfax Capital BV and Ashington Innovation Plc.

Jason Kingsley Drummond (above)

Dan Ferris and Ron Bauer pictured below.

Ferris is currently wanted by the FBI for investor fraud , whilst Bauer was arrested in the UK as part of the same fraud scheme involving Ferris, as published by the Daily Mail in April 2022. Bauer has also been prosecuted previously for market manipulation in 2005.

Willett confirmed the terms included Ferris and Smart raising the initial capital. He also sates clearly that the plan is to list on Nasdaq:

Ultimately, Ferris and Smart rounded up the minimum number of investors needed for OTC. Several of these entities belonged to Ferris.

Two offshore companies “Balmoral Asset Management” and “Blue Atlas Investment Holding Limited” both belonged to Dan Ferris. In addition, Ferris put forward Marianne Thoumsin (his wife/partner), who then became the “first depositor” for the company. That means she deposited her shares before any other shareholders.

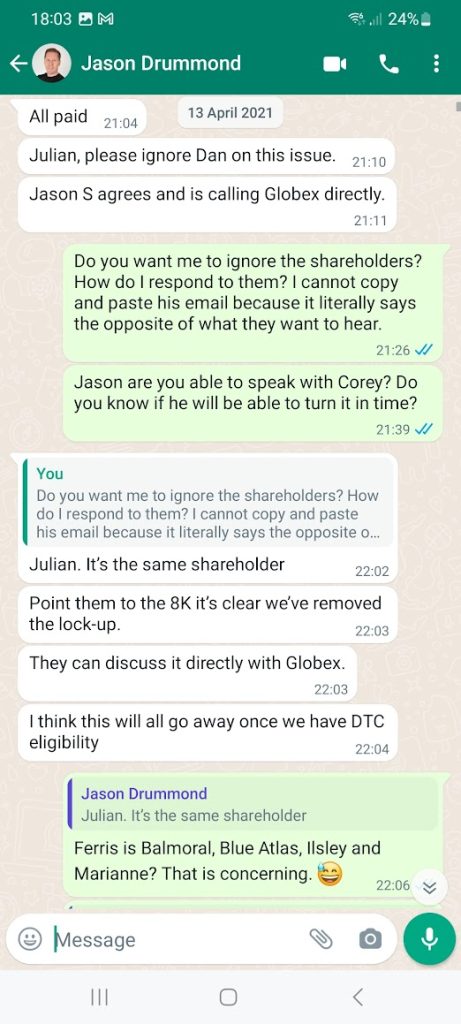

Jason Drummond later confirmed that he knew Ferris’ entities were “the same shareholder” in a WhatsApp message to Julian Parge (a former consultant for GMGT):

Willett, through Epsilon (a Singapore-based entity), orchestrated the acquisition of the assets of Gametech UK Limited with Ron Bauer and Jason Drummond:

Bauer (of Bonsai Capital Ltd) and Epsilon wanted to fund the acquisition:

However, some of the secured loan note holders of Gametech UK refused the transaction, which forced Begbies to apply for a court order to allow the sale of the assets.

Begbies subsequently accepted a deal in 2018 with Willett and Drummond at the helm. This was facilitated through a shell company called Nenx Gaming Limited (later renamed to Dito UK in 2019 and subsequently to Gaming Technologies Limited in 2021), which was established by Andrew Eggleston, a chartered accountant and CEO of EWP, who is a close friend of Oliver Willett.

Eggleston established the shell company under the name “Smart Tower Limited” in 2017, specifically for this acquisition.

Eggleston remained a director of Nenx Gaming until Drummond took over in 2019, even though Drummond had been operating as a shadow director in the background since the acquisition. This also allowed the company to obtain a Metro Bank account in the UK.

In return, Eggleston was awarded over 460,000 shares in GMGT, and was ultimately one of the only people able to make a profit from the sale of GMGT’s shares (with most of the other entities belonging to Daniel Ferris).

Once the assets were acquired, Drummond attempted to “reboot” Gametech UK and reattempt its failed AIM listing through the US OTC Market, with new investors that had no significant knowledge or connection to Gametech UK. He did this with the help of Dan Ferris, an old friend and an associate of Ron Bauer, and Ferris’ business partner Jason Smart.

Ferris connected Jason Drummond to Jason Smart:

Jason Smart founded Ashington Innovation PLC in 2023, and invited Drummond to become a director, after the demise of GMGT.

Drummond resigned from Ashington 1 day after the information in this article became public.

Vale’s gambling licences

The licence scandal and problems with vale.mx began when Drummond signed an agreement with Big Bola Casinos in Mexico:

The agreement stipulated that there would be a minimum participation rate of $10,000 USD per month (or 40% revenue – whichever was higher), which, by month 13 of operations, increased to a minimum of $40,000 USD per month.

Drummond never paid Big Bola, and he ran the casino through Markor Technology despite telling everyone that Gametech had its own casino software (it was disclosed in multiple K and Q filings on OTC that GMGT were building and using their own software).

Markor had a minimum monthly fee of $15,000 USD, which now puts the operating costs of Vale.mx at $25,000 per month, increasing to over $55,000 per month after the first year.

Markor were never paid either, and so they continued to run the casino in the background to try to make up for their losses. This went on for over a year.

Drummond then tried to sue Markor through Fieldfisher, but failed to litigate because he had used up all of the company’s money (mostly on himself, which you’ll see further down).

Drummond then terminated the Big Bola agreement:

The agreement was terminated in favour of a better deal with Fabulous Vegas Games.

Fabulous Vegas charged only 8% with a minimum of $6,000 USD per month, but also wanted an up-front fee and shares in GMGT.

When questioned about the situation with Big Bola by Fabulous, Drummond lied to Fabulous and told them that the debt with Big Bola was disputed and that he had never agreed to pay such an unfair amount of money (despite having signed the earlier Big Bola agreement):

Markor were subsequently swapped out for an agreement with Game Interaction Group, who charged a minimum of € 9,000 EUR per month from month 4:

As time passed, Drummond also failed to pay Fabulous Vegas and Game Interaction Group. Subsequently, several players lost money as the casino was suspended, and they had to make chargeback requests. Vale’s operators and SEGOB (the Mexican gaming authority) received a number of complaints. This created a problem for Fabulous, who then revoked the licence agreement, which Drummond refused to accept:

Ultimately, GMGT had no licence as of June 2023, and the casino was suspended as early as March 2023 for non-payment.

Despite the suspension, GMGT filed its 10-K in May (a late filing, as all the filings had been due to monetary issues rendering the company unable to pay its auditor and its CFO Steven Plumb). The 10-K made no mention of the suspension (which should have been disclosed in an 8-K as it was a material event), and the 10-K further went on to suggest the company still had a licence with Fabulous Vegas Games.

Canelo and the fake competition

In April 2021, GMGT paid over $1,500,000 to Saul “Canelo” Alvarez, a world champion boxer. In return, Canelo wore a Vale.net logo on his shorts. Vale.net was a landing page for a sweepstake competition which had links to vale.mx – the casino. Canelo wore the logo on his boxing shorts for a single fight against Billy Joe Saunders, and he made a few promotional videos through WPP Grey.

The videos were not owned by GMGT because the company failed to pay WPP and by the end of May 2022, there was still over $1,500,000 USD outstanding to Grey in relation to the Canelo campaign. Drummond said he “did not agree” with the invoices and never paid them, so the entire $1.5m invested into Canelo was wasted.

Very few players joined the Vale.mx casino from this fight. Approximately 110 people signed up to a sweepstake competition to win a BMW through “Vale.net” (the logo on Canelo’s shorts), but the BMWs were later cancelled as they were never paid for in full, and a winner was never chosen.

The change in operations

On the surface, GMGT appeared to be just another ordinary US public company on OTC. It was dedicated to providing gambling software to popular brands. This was the original narrative described in the company’s registration statement (page 4 onwards – “Business Overview”).

The narrative later changed substantially (see Page 1 of the last 10-K, filed in May 2023), and the company went from “licensing its own software” for revenue share to “building global gaming brands” under its own licences.

This is the original pitch deck for Dito, Inc. (the original name for GMGT before it was listed):

This was the last pitch deck for Gaming Technologies, Inc., in 2023:

Not only was the name changed, but the company went from being a “software provider” to running its own casino. Drummond was afraid to state that the company would run its own casino on the OTC IPO due to the likely delay that it may have had as a result of increased due diligence requests by FINRA and the SEC (licence information, legal information, etc.). They would have found out that Drummond previously had his UK PML (Gambling License) revoked:

This letter clearly states that Drummond:

- was aware that Gametech did not have adequate resources available for the purpose of carrying on the licensed activities.

- was aware that Gametech was using customer funds to cover its operating costs

- either provided false and misleading information to the UKGC, or did not work with them in an open and co-operative way.

Again, this would have definitely prevented the company from being able to list, and again shows an authority stating categorically that Jason is negligent at best.

Jason Drummond served himself, and no other

Once the money started coming in from investors, Jason Drummond helped himself to it. He took over $1.4m in the four years of GMGT’s tenure on OTC. This information is reflected in the 10-K filings found here.

You can see section “F-20” on the 2021/2022 10-K, and section “F-17” on the 2019/2020 10-K.

Drummond strategically prioritised other payments as per whatever he thought was most urgent (generally the auditor and CFO Steven Plumb), but predominantly he always ensured that he was paid first, whenever money came in, and he always ensured that he was paid the most.

In 2021, despite the company’s significant debts to various suppliers (Markor, Big Bola, various advertisers, various staff, etc.), Drummond helped himself to over $589,000.

Drummond had originally assigned himself an informal salary of £240,000 GBP per year (despite arguing with staff that the company was a startup and that their salaries had to be kept low), but he actually ended up taking on average £275,000 GBP per year. At the same time, suppliers were not paid, and staff were consistently paid late – or not at all, as was the case for several staff who quit with substantial payments outstanding.

In addition to his “startup salary”, Drummond helped himself to cash whenever he felt like it by using the company’s bank accounts as his personal piggy bank. He made a number of suspicious VAT reclaims and R&D tax claims.

At one point the UK subsidiary of GMGT received a penalty of nearly £60,000 GBP from HMRC, for Drummond’s attempt to claim VAT through his service company MY8 Limited, which he used to invoice Gametech for his salary:

In July 2022, Drummond helped himself to £70,000 after a £230,000+ R&D tax credit. R&D credits are around 30% of the claim, therefore any claim for this amount of return would have had to be over £1m. Since the company did not qualify for such a claim, the claim would have had to have been fraudulent.

Further, Drummond used the company’s Wise (TransferWise) account to continually send himself money.

Despite the documents being date Q1 of 2023, the address of 413 W 14th St New York has not been updated. None of the company’s formal documents contain a valid or legitimate company address at which the company could receive mail.

This behaviour of helping himself to company money continued throughout the four year tenure of GMGT.

The unavailable funds

Gaming Technologies, Inc., was cleared by FINRA and approved for OTC Pink on 3 March 2021. The company became DTC eligible on 9 June 2021 and received OTCQB approval on 11 June 2021. The company was then approved for Nasdaq on 8 February 2022, however Drummond could not complete the Nasdaq uplist because the company had no money and no revenue. This is entirely due to Drummond’s behaviour with the company’s money.

In February 2022, Drummond started leasing a luxury apartment in Miami, despite that he could only spend 90 days per year in the US. Drummond didn’t get a visa until May 2023.

The lease was terminated in December 2022. Drummond had stayed there for less than three months in total, and no other staff or consultants were permitted to use the apartment.

In addition to the apartment, Drummond purchased a $20,000 car in January 2023 using the company’s money, despite knowing that the overwhelming and mounting debts of the company couldn’t be covered.

The bottom line

Jason Drummond consistently misled investors to obtain further funding. Ultimately, he used this money for his own personal benefit, at the cost of nobody else getting paid, and only to support his “image” of wealth that led other investors to believe he was a credible and successful entrepreneur.

Over £7,000,000 GBP was lost by investors in Gametech UK Limited which ultimately went into administration. Over a further $9,000,000 was lost by investors in GMGT.

In total, Jason Drummond has caused losses in excess of $18,000,000.

The company failed to generate any revenue which could have supported its growth, with the entirety of its small revenue from Vale.mx casino going directly to Markor (and later to Fabulous Vegas, who also owned Paycips – Vale’s payment gateway and Mexican bank account), to cover their own minimum monthly fees.

Drummond is negligent at best, and completely fraudulent at worst. He cannot be trusted to run any other businesses. If you have been approached by Drummond for investment and you are subsequently aware of this article, you should walk away. Fast.

Actually Hugh with the sale to Web.com being made at £12 million it means if Virtual Internet started with a listing at £15 million it was still sold at less than it started from at £12 million. In between those investing at inflated values lost a shed load of cash.

The company itself, Virtual Internet lost millions every year.

In what sense was Virtual Internet a success?

What about the fraud by Begbies? When are you going to expose that fraud organization?

Really Hugh! Andy says it perfectly:

“Virtual Internet’s value was part of a market bubble and the company lost millions each and every year. While it did briefly hit a value of £200 million it’s shares soon crashed from 900p to 15p. It was sold to Web.com for £12 million after Drummond was left the board. I don’t think investors who paid 900p a share were too happy receiving 46p from Web.com.

FairFx is a good idea and Drummond does appear on the face of it to be a good ideas man. He can’t run a sustainable commercial business though and was a minority investor at FairFx. I heard the main player’s there got him out when they realised what he was all about.”

Your view, below, does not correlate with the facts:

“Drummond built FairFX from his idea in 2006 to listing the company on the London Stock Exchange in 2014 – it’s got over £180m market cap. Same deal for Virtual Internet – £15m to over £200m and then sold to Web.com.”

Dear Fraud Exposer

Can you pleas contact us? We are a newly formed TV production- a breakaway from a larger company. We are pitching to a major TV channel a theme of organised crime and the online gaming industry and would like an off the record chat about the subject of this site.

Thanks

Greg O’Riordan

FairFX asked Drummond to leave the business!

Drummond built FairFX from his idea in 2006 to listing the company on the London Stock Exchange in 2014 – it’s got over £180m market cap. Same deal for Virtual Internet – £15m to over £200m and then sold to Web.com.

Not all start-ups work out, at least people like him keep trying to build things and create jobs.

Looks to me like the only mistake he made was giving a loser like you a job, and why are sending emails pretending to be him? I never asked to receive your emails or join your mailing list? go and get a life.

So, why has he no money having built two companies with a market company of close to half a billion? You and he are bull shitters

We have something to publish on FairFX and VI in due course. Jason was forced out of FairFX because he was incompetent and negligent. As for the mailing list, there is a pretty obvious link at the bottom of every email that allows you to “unsubscribe”. Click that link and have a nice day. Our emails are also very clearly not from Drummond. Nobody has claimed or pretended to be Drummond from this website. Are you sure you’re not Drummond?

When you say “not all start-ups” work out, that may be true, but when most of your start ups fail for the same reasons (ie because of negligence and/or misconduct), and that pattern is as obvious as it has been for the 3 entities we’ve published so far, it begs the questions of “why” and “how” he continues to receive investment and support.

Drummond has clearly helped himself over the staff he has “created jobs” for, taking millions at the cost of nobody else getting paid whilst simultaneously doing nothing but taking luxury holidays and coming up with stupid ways to waste investors’ money and build up debts with suppliers that he doesn’t agree with and doesn’t want to disclose in public filings.

There is over $2,000,0000 USD of debt between WPP Grey and Digitronic alone, not to mention the debts with various other suppliers, consultants, license holders, and software companies.

Hugh cannot be serious.

Virtual Internet’s value was part of a market bubble and the company lost millions each and every year. While it did briefly hit a value of £200 million it’s shares soon crashed from 900p to 15p. It was sold to Web.com for £12 million after Drummond was left the board. I don’t think investors who paid 900p a share were too happy receiving 46p from Web.com.

FairFx is a good idea and Drummond does appear on the face of it to be a good ideas man. He can’t run a sustainable commercial business though and was a minority investor at FairFx. I heard the main player’s there got him out when they realised what he was all about.

The 24th of May 2017 UK Gambling Commission letter alone would make me run a mile from investing with this guy.

Dan Ferris was in London last month so he can’t be wanted that bad if hes still travelling.

He is in Monaco now….

Do you have any more information on this and any proof we could publish (like a timestamped photo or travel document)? Do you think that maybe he has a plea deal? Either way that shows without a doubt that the FBI/SEC/etc. are just useless. It really reinforces why we need to publicly shame these criminals.

Maxwell, Trump, Madoff, Holmes, Stamford et al – they all denied or deny they were or are conmen. Accusers were always attacked when they blow the whistle. Fraud Exposer may very well be Jason Drummond’s Tyler Schultz. Keep telling it as it is!

I am so happy this website has been put up to expose Jason Drummond and his tactics.

I am a former investor in Gametech and lost all my money. If a business fails (which most start ups do) then I would have moved on but I know that Drummond made money during and after the downfall of the UK business. He is a serial conman and should be avoided at all costs.

Is there a smoking gun here? Maybe, maybe not – I’m still reading and digesting. On a simple smell test though, from what I have read, if this guy offered me an investment opportunity I would run quicker than a Canelo Alvarez opponent hitting the canvas.

Is there a smoking gun here? Maybe, maybe not – I’m still reading and digesting. On a simple smell test though, from what I have read, if this guy offered me an investment opportunity I would run quicker than a Canelo Alvarez opponent hits the canvas.

I wonder why Drummond has not come here to shred Fraud Exposer’s claims….maybe they are all true so he is keeping his head down

The lady, Anna, doth protest too much.

What an amazing exposee of a lowlife. Gllad I decided not to invest.

We need more people like the author of this to expose bad ‘un’s

As an impartial observer, from the details that you shared here, there’s no smoking gun, and all you have intimated is conjecture.

based on the fact that a few of Jason‘s ideas didn’t ultimately work out, but that’s the case with any failed start-up. Hindsight is always 20:20 but at least he tried to make a go of it.

What’s was your role exactly, Stephen plumb?

You are missing the point of the article. If all of Jason’s start ups are failing because he is wasting the money and helping himself to most of it at the cost of not paying the company’s suppliers and staff, he is simply not fit to be a founder or a CEO. Our role is to expose that specifically so that future investors he tries to scam are fully aware of what will likely happen to them and what has consistently happened to everyone else. You are hardly impartial if you side with Drummond and fail to see the value in what has been posted above.

We all know Donald Trump is an honorable man! Sounds as if the bounder, Drummond has got all his dodgy friends to support him

How about you look at why you decided to work for someone if you knew they were crook?? Well?!

Not really normal behaviour is it?

Get a real job and a life yourself while you’re at it.

Regards,

Emma swift

The whole article proves without question that Drummond is a liar and a manipulator. Nobody suspected him and people were screwed over. Revealing the truth and making future investors aware of Drummond’s incompetence is certainly not a bad thing. We are saving people from further losses.

Anna is Jason bonking you too?

There’s nothing shocking in what you are reporting there. The only shocking thing is the way you chose to contact people: Anonymously, without accepting replies. This kind of behaviour will not help you get people on your side.

If you really are a group of people who have banded together, then how come you haven’t contacted everyone with your name before making this website? You wanted to band with a selection of people, while being secretive to other people? Does that mean you don’t see me as one of those you wanted to band with? Or you don’t trust me?

Anyway, you can be secretive all you like. I know who you are. You have no idea how much information about yourself you have given away.

You chose not to get me on your side, you chose to contact me in the worst possible manner and I can’t understand why. I would have been able to give you a lot of information. But apparently I’m not one of the people you want to band with.

What difference does it make whether the publishers of the website are named? If you have something to share, just share it. Set up an anonymous email account and send your information to drummondsdownfall@gmail.com. We will publish it.

The issue is people don’t know who you are?! It’s easy isn’t it …. To throw someone under the bus if you’re not brave enough to reveal who you are?!

Come on!

What difference does it make? This article isn’t about anyone other than Drummond. Why are you so focused and obsessed on knowing who’s behind it? It makes absolutely no difference and it’s about to be a lot more people.