As mentioned in the history of Gaming Technologies (OTC:GMGT), Jason Drummond and Jason Smart, who started the controvesial GMGT venture with Dan Ferris (currently wanted by the FBI for investor fraud), together also started Ashington Innovation PLC (LSE:ASHI).

Barely 24 hours after jasondrummond.org published the GMGT article, on August 16 2023, Jason Drummond resigned from Ashington.

24 hours after that, Ashington announced suspension of trading. They separately posted a press release stating that Heads of Terms had been signed between Ashington and Cell Therapy Limited, a subsidiary of Celixir, whose website currently only shows a notice referring to the Heads of Terms.

Ashington then posted a press release a few days later stating that they were also listing on the Frankfurt Stock Exchange under the ticker 6FW.

Further Heads of Terms were then announced with Calon Cardio-Technology Limited.

Only a few weeks after the resignation of Drummond, Ashington gave an update on its discussions with Calon and Cell Therapy, within which Ashington stated that “the proposed acquisition of Calon is dependent on a successful close of the Cell Therapy transaction”.

Fastforward to January 24 2024 where Ashington announces termination of the reverse takeover proposal with Cell Therapy, meaning that the acquisition of Calon has also fallen through. Trading was suspended for over five months, and Ashington’s website has been a holding page for the majority of that time.

A screenshot from the company’s website showing the holding page with only a logo.

Between the announcements of Drummond’s “resignation”, timed accordingly with the publication of his misconduct in GMGT, and the announcement of its restoration, Ashington made more board changes, appointed a new auditor, a new Non-Executive Director (NED – Grant Duthie), and issued 1,200,000 shares “to a former Director in lieu of payment for services”.

We can easily calculate that Drummond’s fee entitlement in his contract with Ashington below, of £18,000 per year, would equate to 1,200,000 shares at 1.5 pence (1,200,000 x 0.015 = 18,000). Half the value of his issuance at 3 pence.

So now that we can safely deduct that the 1,200,000 shares went to Drummond, your attention should be drawn to the following:

- Article 14 of Market Abuse Regulations (MAR), which explicitly prohibits insider dealing.

- Article 7 of MAR, which defines insider information.

It is relatively safe to assume that Jason Smart and Jason Drummond are still close, given that they started the IPO of GMGT together. On that note, it is also safe to assume that Drummond is still an “insider” for Ashington, and should probably disclose the sale of any of his shares.

THE SAME DAY that trading was restored to Ashington, on January 25 2024, 500,000 shares were sold at 1.25p to a total value of £6,250, and so we can roughly conclude that the probable sale of a portion of Drummond’s shares has delivered a new market cap of ~£1m… for a main market listed company.

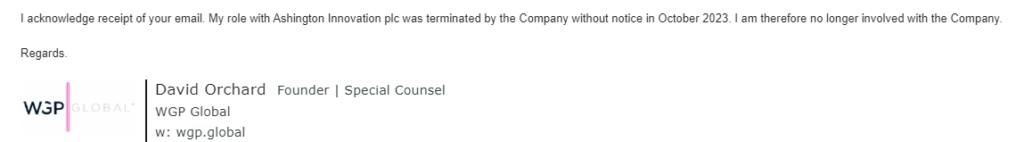

Unannounced events include the termination without notice of Ashington’s counsel David Orchard.

One wonders what a termination without notice actually means, and why such a thing would happen. Was it a material event? Did Orchard uncover some dodgy dealings? Perhaps it didn’t need an announcement, but it certainly stinks nonetheless.

It looks like Drummond is scraping every barrel for pennies now, and so it is strange that he continues his public persona of a man claiming to be “richer than all of the Spice Girls put together” – a dated article by The Guardian from over two decades ago, on which Drummond relies to convince investors of his great success, despite claiming today to those he owes money that he has nothing.

Someone who burns through that kind of money in 24 years would surely fit the profile of someone who takes money from investors to sustain their luxury lifestyle.

Ashington has crashed. Drummond has crashed. The whole shitshow is closing in for a grand finale.

WE STRONGLY URGE YOU NOT TO INVEST IN JASON DRUMMOND OR ANY COMPANY RUN BY THOSE HE HAS ASSOCIATED WITH IN GMGT.

- Do not give your money to Jason Drummond, who spends company funds on himself.

- Do not give your money to Jason Smart, who partered up with Dan Ferris to create a group of fake investors to allow GMGT to qualify for OTC.

- Do not give your money to Dan Ferris, who is wanted by the FBI.

- Do not give your money to Ron Bauer, who has been sued for investor fraud by the SEC long before he was approached to parttake in the establishment of GMGT by Drummond and Willett.

- Do not give your money to Oliver Willett, who invested in GMGT despite having “lost money” in Gametech UK.

- Do not hire Andrew Eggleston as your accountant.

- Do not hire Steven Plumb as your CFO.

Most importantly, keep your money safe from scammers and follow this blog for further updates as we deliver more reports on Drummond’s shenanigans.

Are you a victim of Jason Drummond? Deliver your story anonymously in the comments below or send us something to publish via drummondsdownfall@gmail.com.

My God!!!

How has this investor thief not been arrested

Whoever bought that stock from Ashington is retarded. The companys got nothing going for it and with everything thats been happening only an idiot would buy this stock.